I wish I had a future… on S&P 500 Dividend Aristocrats etf!

I’m always looking around for new market edges… There’s a lot written on high dividends stocks stronger bullish bias over lower dividend stocks. Many articles have been written on fundamentals factors and so on over dividends… I decided to run a simple backtest this morning:

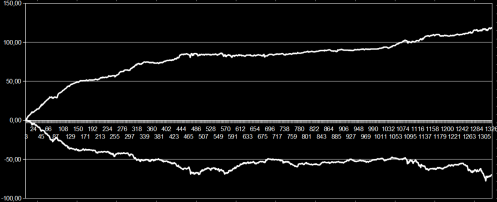

be long every day at the overnight session on NOBL etf (from today’s close to next day’s open), you can see this on the “above zero line” cumulative % return equity curve (not compounded);

the opposite (always long) (from today’s open to today’s close) equity curve is displayed of course below the zero line. It shows a strong bearish edge. Intraday session delivers a total 70% loss being long everyday.

It is clear from the chart above that the overnight session leads to strong performances being long all nights: about 117% return since this etf inception in October 2013.

This is roughly 3 times the equal strategy returns of SPY! (it’s about 35% since 2013)

I wish I had a future…

Marco,

Are you going to be trading this ETF?

regards,

Mark

LikeLike

Well Mark, I would be tempted by the leveraged version of this etf. There’s a 2x one. But it has low liquidity yet.

And I should add some filters on this raw strategy first.

I think it’s worth investigating further.

LikeLike

Very promising idea. Thank you, Marco.

LikeLike

Thank you Alex!

LikeLike