When will the stock market bubble burst?

It’s not easy to time the market. It’s almost impossible. But sometimes, when we are approaching very extreme stock market values, I mean extreme multiple values, extreme ratios, a stock market high call is due.

We have a few big problems with the stock market now.

- First inflation. Yes, everybody’s talking about it. Why? Because it’s 26 years we don’t have such strong inflation numbers. It means something big is waking up. Extreme numbers.

- Interest rates – rising inflation means, rising interest rates.

- CAPM pricing model – when interest rates rise, stock market prices fall.

- Where are interest rates now? In negative territory, never seen before. Would have William Sharpe ever thought about something similar back in 1964? No. Extreme numbers again.

- Why stock market prices are so high? Because of Fed Quantitative Easings, negative interest rates and extremely low inflation for years. Nothing to do with “new economy recovery”. Just financial formulas and Fed money printing.

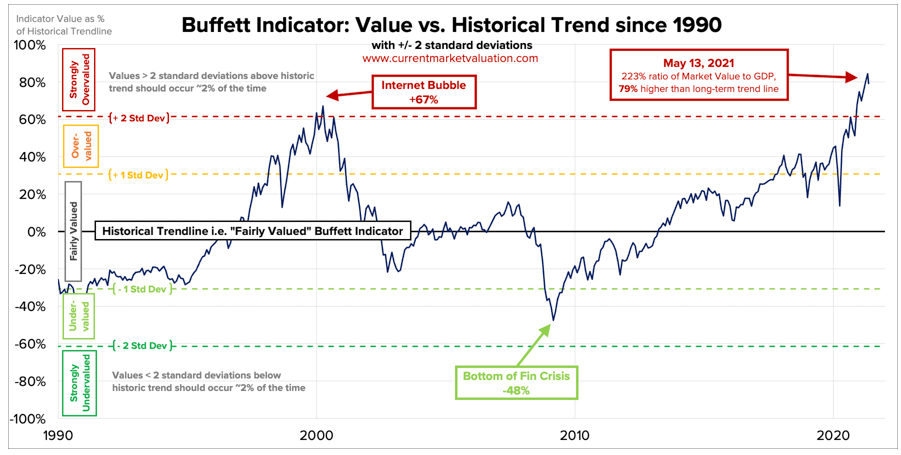

- Where’s the Buffett Indicator now? In extremely overbougth territory, higher than ever before. Have a look at the scary, scary picture below.

- What about seasonality? Well, “Sell in May and go away!” Far away. Be careful guys!

Below you can see a rising wedge, starting with Covid April 2020 lows. If we go back there, it’s a 50% bear stock market reset. This could drive the Buffett Indicator to more normal values to trigger a buy. That’s why with overnight trading we have been so selective recently, maybe too much. We’ll have much more bearish overnight bets starting soon.